Handling journal entries in QuickBooks allows businesses to record transactions that don’t typically fit into other transaction types like invoices or bills. This comprehensive guide covers everything from understanding journal entries to creating and managing them effectively within QuickBooks.

1. Understanding Journal Entries in QuickBooks

A. What are Journal Entries?

Journal entries in QuickBooks are manual accounting entries used to record financial transactions that can’t be recorded through normal transactions (e.g., invoices, bills). They are typically used for:

- Adjusting Entries: Correcting errors or adjusting account balances.

- Accruals and Deferrals: Recording revenue or expenses that occur but haven’t been recorded yet.

- Transfers between Accounts: Moving funds between different accounts.

B. When to Use Journal Entries

1. Adjusting Entries

- Correcting errors in account balances.

- Allocating income or expenses to the correct period.

2. Accruals and Deferrals

- Recording revenue or expenses when they’re earned or incurred, not when cash changes hands.

3. Transfers between Accounts

- Moving funds between bank accounts or different asset or liability accounts.

2. Creating Journal Entries

A. Accessing Journal Entry Form

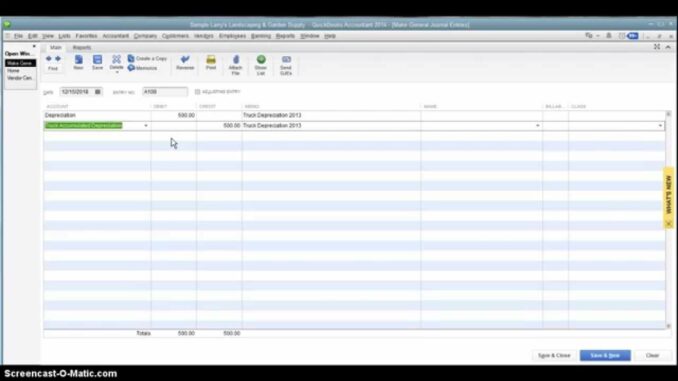

1. Navigate to Create Journal Entry

- Go to “Company” > “Make Journal Entries” in QuickBooks Desktop.

- In QuickBooks Online, go to “+ New” > “Journal Entry.”

B. Enter Journal Entry Details

1. Date and Journal Entry Number

- Enter the date of the journal entry.

- QuickBooks automatically assigns a journal entry number, which you can customize.

2. Accounts and Amounts

- Debit and Credit: Enter the accounts to be debited and credited.

- Amounts: Input the amounts for each account. Debits must equal credits to balance the journal entry.

3. Description

- Provide a description for the journal entry to explain the transaction.

4. Additional Details

- Attachments: Add supporting documents or files.

- Classes and Locations (if applicable): Allocate transactions to specific classes or locations for reporting purposes.

3. Review and Save Journal Entries

A. Review Accuracy

1. Double-Check Entries

- Review debit and credit amounts for accuracy.

- Ensure accounts are correctly assigned.

B. Save Journal Entry

1. Save and Close

- Click “Save” or “Save and Close” to record the journal entry.

2. Edit or Delete

- Edit or delete journal entries if needed before finalizing.

4. Managing and Editing Journal Entries

A. Locate Journal Entries

1. View Journal Entries

- In QuickBooks Desktop, go to “Reports” > “Accountant & Taxes” > “Journal.”

- In QuickBooks Online, go to “Reports” > “All Reports” > “Accounting” > “Audit Log” or use the “Journal Report.”

B. Edit Journal Entries

1. Open Journal Entry

- Locate the journal entry you want to edit.

- Click “Edit” to make changes.

C. Delete or Void Journal Entries

1. Voiding Entries

- Void a journal entry to maintain a record while reversing its effect.

- Click “Void” and follow prompts to confirm.

2. Deleting Entries

- Delete a journal entry entirely if it was created in error.

- Click “Delete” and confirm deletion.

5. Best Practices for Handling Journal Entries

A. Use Standard Account Practices

1. Follow GAAP Principles

- Adhere to Generally Accepted Accounting Principles (GAAP) when creating journal entries.

B. Maintain Documentation

1. Document Transactions

- Keep supporting documents for each journal entry, such as invoices or receipts.

C. Reconcile Regularly

1. Reconcile Accounts

- Ensure journal entries reconcile with other transactions and account balances.

6. Common Errors and Troubleshooting

A. Addressing Errors

1. Incorrect Amounts

- Verify debit and credit amounts for accuracy.

2. Wrong Accounts

- Ensure entries are posted to the correct accounts.

B. Seeking Help

1. QuickBooks Help Resources

- Access QuickBooks Help for guidance on journal entries and troubleshooting.

2. QuickBooks Support

- Contact QuickBooks Support for assistance with technical issues or complex entries.

3. Community Forums

- Join the QuickBooks Community Forums for tips and advice from other users.

7. Finalizing Journal Entries

A. Audit and Review

1. Audit Trail

- Review audit trails to track changes and maintain accountability.

B. Reporting and Analysis

1. Financial Reports

- Generate financial reports to analyze journal entries’ impact on overall financial health.

C. Backup and Security

1. Backup Data

- Regularly backup QuickBooks data to prevent loss of journal entries.

D. Compliance and Regulations

1. Compliance

- Ensure journal entries comply with regulatory requirements and tax laws.

8. Conclusion

Mastering journal entries in QuickBooks is essential for maintaining accurate financial records and ensuring compliance with accounting principles. By following these steps and best practices, businesses can effectively manage and record transactions that fall outside typical transaction types, improving financial transparency and decision-making capabilities. Regular review, reconciliation, and documentation are key to leveraging journal entries for robust financial management in QuickBooks.